ATO & Useful Dates

Keeping on top of all of the due dates when you’re running a business is never easy. Here we have provided a list of the important ones!

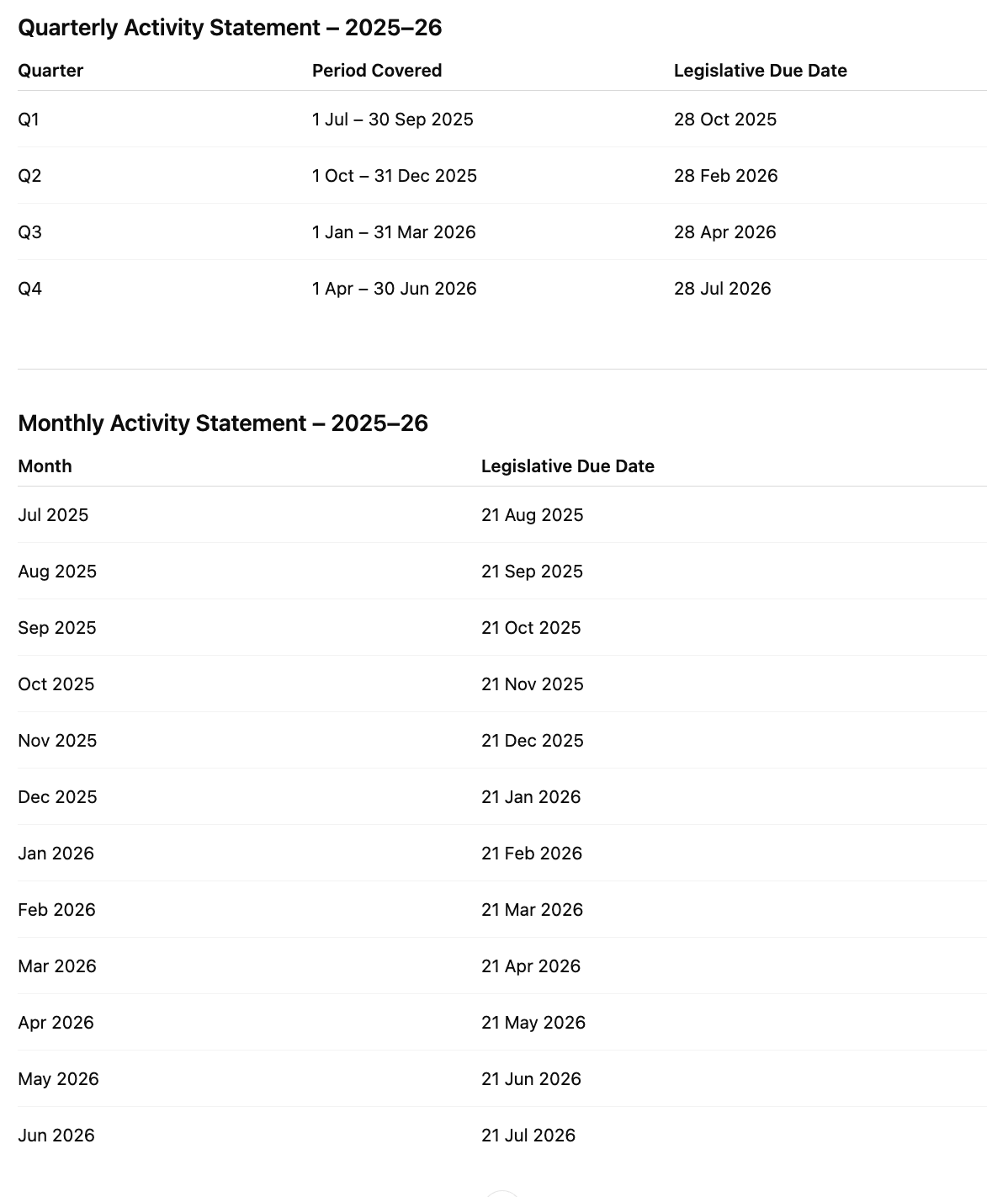

Quarterly BAS

Lodging a BAS (Business Activity Statement) is an important part of running your business. If your turnover is between $75,000 and $20 million, you’ll need to submit a BAS every quarter to report your GST to the ATO.

If you have employees and withhold tax from their wages (PAYG Withholding), this also needs to be included in your BAS.

Any GST and PAYG amounts you report must be paid to the ATO. If you lodge your BAS yourself, it’s due by the 28th of the month after the quarter ends. But if a registered BAS Agent (like us!) lodges it for you, we get a little extra time—usually about a month longer—to submit and make your payment.